property tax consultant license

The course covers tax appraisal guidelines and. This is what they told us.

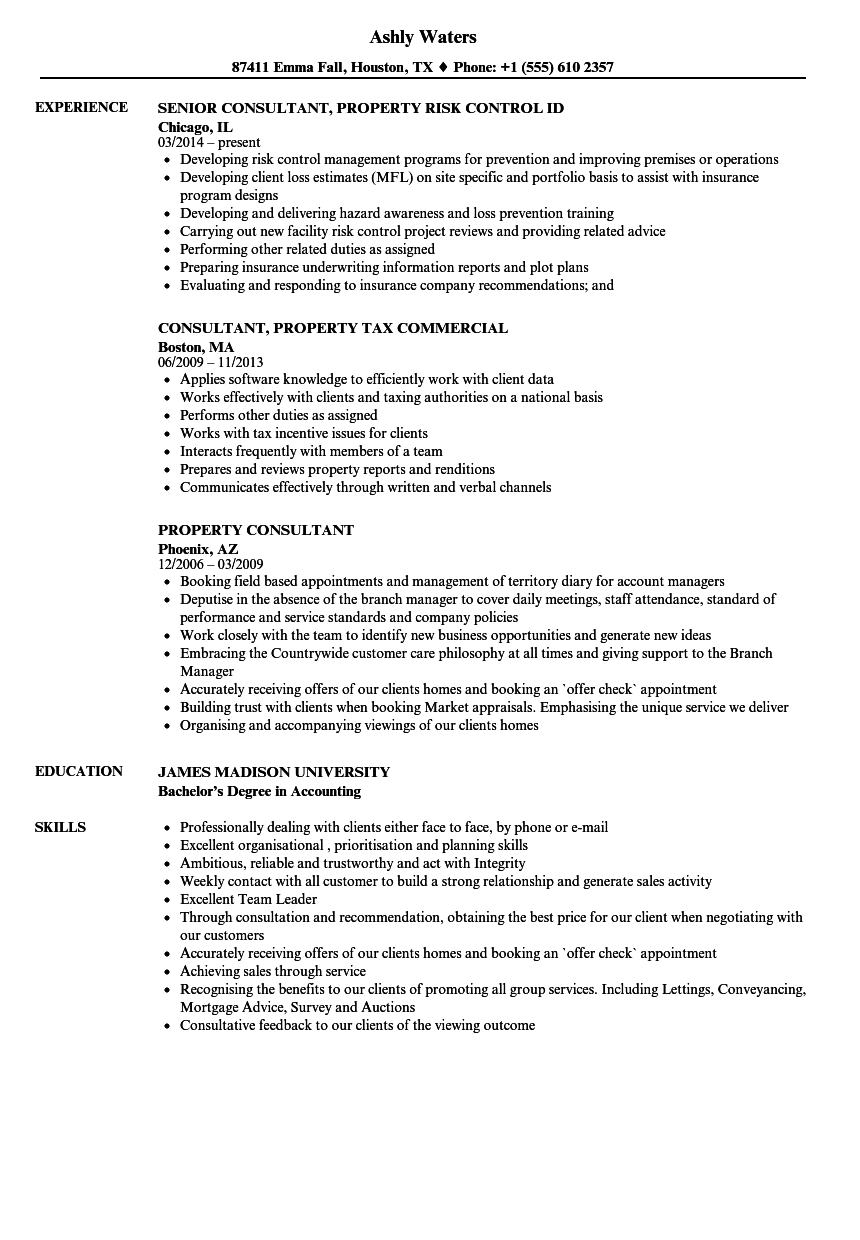

Tax Consultant Resume Samples Qwikresume

Regardless of the state that you live in property tax consultants need to be properly licensed trained and educated to work as a tax consultant.

. As a TDLR-licensed provider we have the knowledge expertise and familiarity to ensure your information. Property Tax Reduction Consultants 255 Executive Drive Suite 210 Plainview NY 11803 516 484-0654 631 484-0654. This Texas Department of Licensing and Regulation TDLR approved course satisfies all twelve mandatory hours of your annual Property Tax Consultant Continuing Education Requirement.

He brings to the table. Submit a fee of 50 25 registration fee plus an application fee of 25. COMPLETE PROPERTY TAX CONSULTING COURSE Tax Consultant Course a.

The Notice of Intent to Review was publishe See more. 100 of job seekers said required for my current job was the biggest reason for earning their. We asked 2 job seekers about their Property Tax Consultant License.

EXTREMELY PROFITABLE since few if any property tax consultant specialists likely work within your zip code. Property Tax Professionals Education. This 24 Hour Online course meets all TDLR requirements for Property Tax Consultants to renew their license in Texas.

An applicant for a property tax consultant registration must pass a department-approved examination for property tax consultants and successfully complete at least 40 classroom. He holds the Senior Property Tax Consultant License the highest license awarded by the Texas Department of Licensing and Regulation for Property Tax Consultants. The Texas Comptroller of Public Accounts is required to approve continuing education programs and educational courses for property tax appraisers.

This rule review is required every four years. Ste 210 Plainview NY. The Texas Department of Licensing Regulations requires that all PROPERTY TAX consultants complete 12 hours of continuing education.

11803 516 or 631 484-0654 Fax. Property Tax Reduction Consultants 255 Executive Dr. The Texas Department of Licensing and Regulation Department is reviewing the Registration of Property Tax Consultants program rules located at Title 16 Texas Administrative Code Chapter 66 for re-adoption revision or repeal.

IS LICENSED BONDED AND INSURED TO PROTECT. TX PROPERTY TAX CE Requirements. To become licensed a consultant typically.

The required 12 hours must be taken within the calendar year immediately prior to the. Property Tax Consultant License Texas. This 12 hour online course meets all tdlr requirements for.

Property Tax Consultant licenses expire each year on the day the license was originally awarded.

How To Become A Tax Consultant Education Requirements More

Tax Consultant Resume Samples Qwikresume

Property Tax Consultants In Texas Tax Consulting Services In Texas

Property Consultant Resume Samples Velvet Jobs

Property Tax Consultants In Texas Tax Consulting Services In Texas

Property Tax Consultants In Texas Tax Consulting Services In Texas

Tax Consultant Invoice Template

Tax Consultant Resume Samples Qwikresume

Tax Accountant Resume Samples Qwikresume

Property Tax Consultants In Texas Tax Consulting Services In Texas

What S A Property Tax Assessment Nerdwallet

Property Tax Consultants In Texas Tax Consulting Services In Texas

Accounting Taxation Legal Digital Marketing Business Consultant E Filing And E Solutions Digital Marketing Seo Digital Marketing Corporate Law

Tax Accountant Resume Samples Qwikresume

Property Tax Consultants In Texas Tax Consulting Services In Texas

Tax Consultant Resume Samples Velvet Jobs

Property Tax Consultants In Texas Tax Consulting Services In Texas